Bill’s Blog Aug 13, 2020

When I teach on wealth diversification, I mean having your wealth diversified in non-correlating assets. Often people are told by their financial advisors I will diversify your portfolio between stocks and bonds (which is generally a good thing). However, due to the market distortions caused by central banks they have become more correlating especially when you have major volatility and the chance of a market crash. Another important consideration is counter party risk in any asset class. As an example, real-estate is very vulnerable to interest rates…which is a real counter-party risk.

Many Canadians wealth is in the stock market and real-estate. Truthfully, these asset classes have been a great place to have a sizable portion of your wealth historically. But what happens when they become extremely over-valued by historic norms? History is a great teacher, except for those who ignore her wisdom.

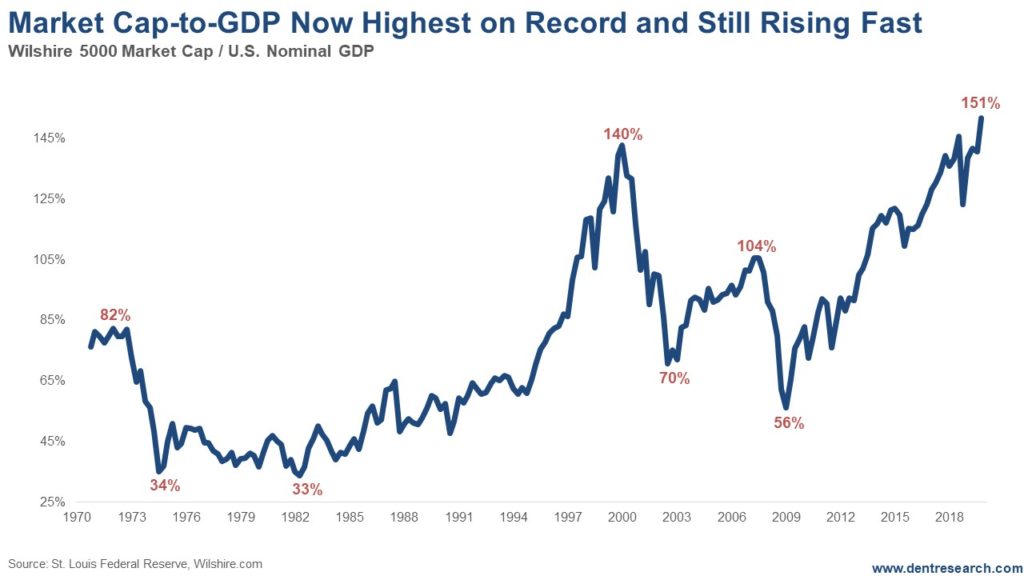

In a healthy stock market, the total valuation should be around 70% of the GDP of a nation. The US current stock valuation is close to 160% and largely driven by the FAANG stocks. This is a HUGE RED FLAG and I suggest you pay attention, especially if you have a significant portion of your retirement wealth in the stock market. This slide below only goes to 2019. We are now over 160%…look what happens when a stock market becomes overvalued like in 1973, 2000, and currently. You always get a major crash! There is a large disconnect between the real economy and the stock market. I would be very careful going into the fall (September to November) due to record levels of unemployment, business bankruptcies, massive debts and a serious global recession…possibly a depression.

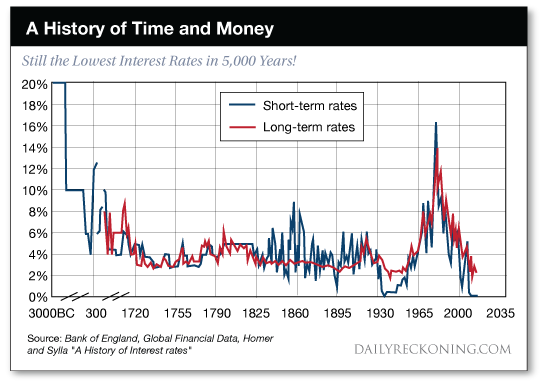

Well, what about real-estate? Hey, the markets have never been stronger and prices continue to rise to even higher levels in many markets. Very few people step back and analyze the key reasons…let me give you one hint…we have the lowest interest rates in all of human history. This has created a significant distortion in real-estate prices and people falsely believing real-estate markets can’t correct or even crash. When interest rates go up and they will at some point, this will create a huge problem for many Canadians and the banks. For now, supply and demand are strong in many markets; however the issue of affordability must become realistic at some point and it will.

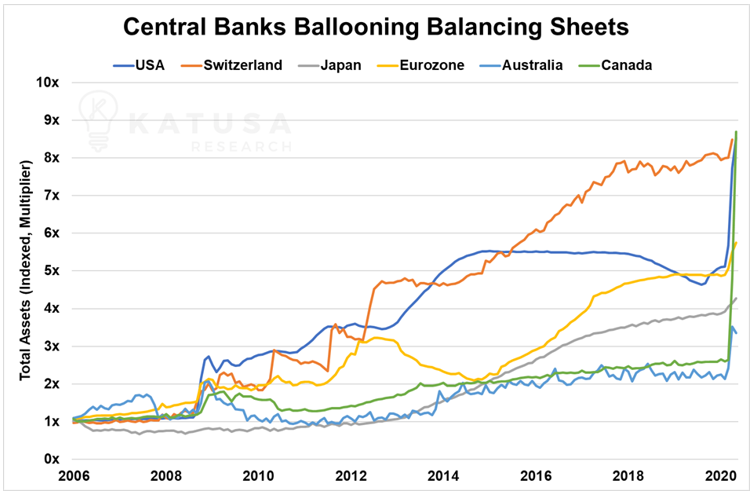

Few people remember what happened in the late 1970’s. Real-estate values doubled in price in that decade due to high inflation, big money printing by central banks, and market demand. This created a bubble and high interest rates corrected the problem. By 1980 interest rates sky rocketed to 22% in Canada and hundreds of thousands of Canadians lost their homes as they could not afford the mortgage payments when they refinanced. Ignorance of history will not help you when rates climb again, and they will as governments and central banks print money into oblivion. See the third chart…scary!

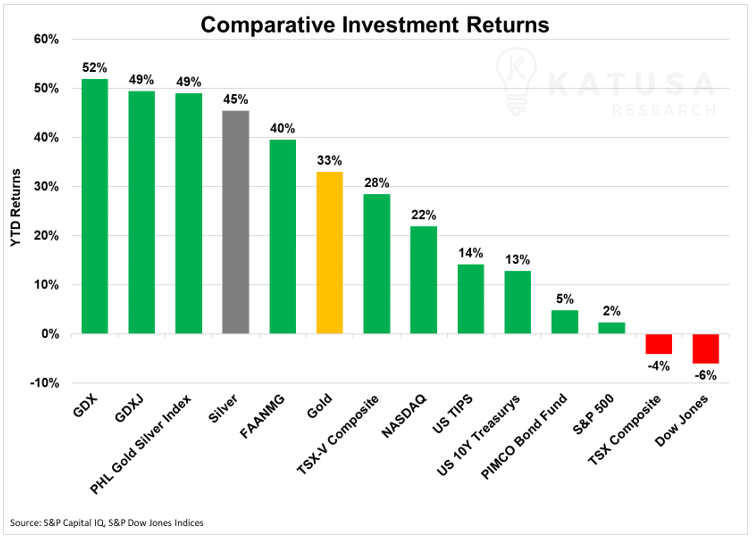

I am not sharing this to bum you out, but to prepare you for what is coming. Most important to teach you the importance of diversification into assets that do extremely well in ultra-low interest rates and massive money printing. Take a look at what are the best performing assets classes in our current markets in the chart below. Five of the top assets are gold and silver. One major asset class has been omitted and I will cover that shortly.

So why are gold and silver appreciating so rapidly? Here are a number of the main reasons.

- People and financial institutions are waking up to the fact that our governments and central banks are on a constant money printing binge which devalues our currencies. We are all losing our purchasing power.

- Gold and silver are scarce and they hold purchasing power especially in high inflation.

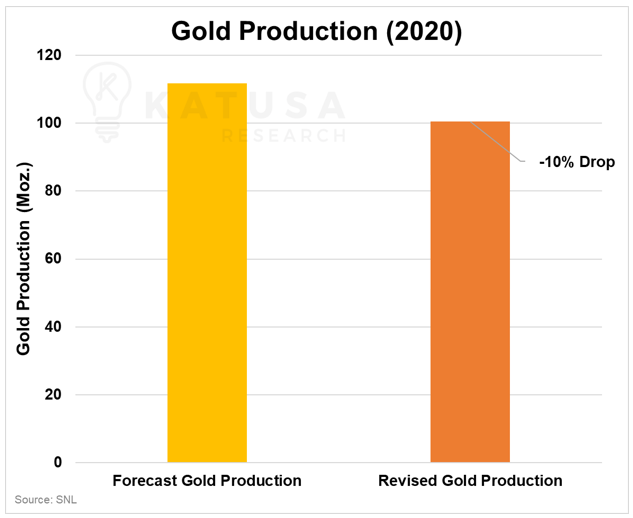

- Hundreds of mines have been shut down temporarily due to the Covid-19 crises which has led to shortages. Mints and refineries have reduced production since they cannot get physical stock. We are also seeing bullion dealers have a hard time getting investment grade gold and silver, so premiums have shot up. Shortages of physical metals will continue to be a big problem, and continue to drive the prices higher.

- Gold in the last couple weeks broke through its all-time high price of $1921 in US dollars and now has no resistance. Gold has appreciated 34% already this year and its at a all-time high in purchasing price in every fiat currency in the world.

- Gold became a Tier-1 asset last year determined by central banks (that means it has a 1 to 1 ratio in value equal to a treasury note). No surprise as central banks have been amassing large tonnage over the last 9 years and now have over 30,000 tonnes combined.

- Silver is significantly undervalued compared to gold. Silver has so many real-world applications (technology and medical) and historically it has been the longest standing form of real money. Many experts see silver hitting triple digit values in the coming years and I don’t disagree. Silver has gained almost 50% this year, until the recent pullback!

- Listen to Mike Maloney’s 10-minute video update. Mike is a very respected precious metals expert who I have followed for over 12 years. He was one for the few analysts who accurately predicted the 2007-2009 crash well before it happened: https://youtu.be/Bxda6w32lQM

- Lastly, the government can’t print physical gold or silver out of thin air like their fiat currencies…history tells us all fiat currencies eventually become worth-less. Make sure you own physical metals outside the banking system…. very important. If you need guidance, I can help you with purchasing silver and gold and with proper storage. Gold and silver production are way down this year. Silver production down over 6.5% in 2020.

One of my favorite ways to diversify is cryptocurrencies. Remember I said I would share an asset class that has outperformed all asset classes in 2020. Well Bitcoin alone is up over 60% so far this year. Many other quality crypto-projects are up 100’s of percent this year. I see even more appreciation in a few select cryptocurrencies in the coming months and years. Why? Let me explain the most important reasons.

- Global adoption of world class projects. Truthfully of the over 6300 projects listed on CoinMarketCap.com there are maybe a few dozen projects that will become successful and meet real-world needs. Many experts believe that over 95% of crypto projects will fail.

- Global governance and regulation around cryptocurrencies have made big progress in all major countries especially in 2019. Projects need to pay attention to this if they hope to have any real adoption.

- Blockchain is a superior way to transfer data, store data, create smart contracts and do financial transactions seamlessly and globally. I favor decentralized projects, but clearly many countries, banking cartels and major corporations are diligently developing centralized blockchain systems.

- Clearly there has been a push to get rid of cash in all countries world-wide and this will have far and wide-reaching consequences. Many experts fear the loss of privacy and freedom when all fiat currencies are banned and I don’t disagree. I believe we have 5 to 10 years max before this becomes a reality. All commerce will be 100% digital in transactions in the near future.

- One of the most important features of cryptocurrencies, is your ability to transact anywhere in the world that has internet/smart phones without 3rd parties or excessive bank fee’s.

- Adoption of Bitcoin by major financial institutions has significantly increased globally. Cryptocurrency is becoming mainstream in the markets now with a cryptocurrency EFT (Bitcoin Investment Trust, symbol GBTC). This is NOT a recommendation; I am just pointing out the fact.

- When we have the next banking crisis or financial reset, it is very possible the banking system will be shut down for a season. How will you transact without credit cards or Interac? Ask the people of Argentina or Venezuela who had foresight before their banking and monetary systems collapsed. Those who had some of their wealth in cryptocurrencies did very well and could still buy and sell and maintain purchasing power. Those who had only fiat currencies were wiped out financially, as their currencies become worthless in hyper inflation. This same bad dream has happened thousands of times in history, so pay attention and prepare! Having a small portion of your wealth in a few select cryptocurrencies creates another way to diversify and has significant upside potential.

- For those interested I provide a 3-hour consulting session $125.00 per hour in person or online. I have spent well over 1000 hours studying cryptocurrencies/blockchain and I provide a solid foundation of understanding of this revolutionary technology. I will cover a brief history, understanding the difference between crypto and blockchain. What to avoid and how to safely set up an account and what assets to consider. Also, how not to lose your crypto assets! It is very important you educate yourself before you speculate or invest in any asset class!

In conclusion, if you do not clearly understand the importance of physical precious metals or cryptocurrencies for wealth diversification, then I can help you. My passion for years has been to educate people on critical financial topics and provide solutions. To be clear I am not against real-estate or the stock market as I have participated in both for decades. However, when I see historic over-valuations and distortions in the market I feel responsible to both warn you and provide quality solutions.

I can be reached by my cell: 778-539-7107 or bill@fivefoldfinancial.ca